Global Business Travel Spending to Reach $1.57 Trillion in 2025: GBTA

[ad_1]

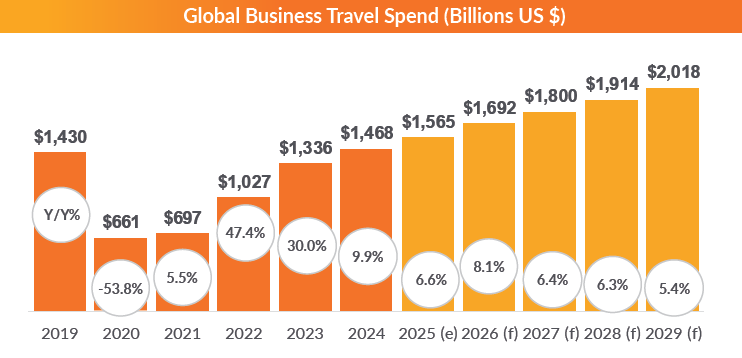

GBTA’s annual Business Travel Index Outlook report displays reasonable near-term development, regional and sector divergence, and evolving traveler expectations reshaping the subsequent section of enterprise journey. Global enterprise journey spending is projected to attain a brand new historic excessive of $1.57 trillion USD in 2025. This represents a reasonable year-over-year development charge of 6.6%, as world spending is anticipated to sluggish this 12 months due to commerce tensions, coverage uncertainty and financial pressures. A rebound to 8.1% development is projected for 2026, whereas long-term forecasts stay clouded by geopolitical and financial volatility.

Despite near-term challenges, world spending is projected to surpass $2 trillion by 2029 ─ one 12 months later than anticipated a 12 months in the past ─ pushed by structural shifts in commerce, funding, and company journey conduct.

This is in accordance to the newest version of the GBTA Business Travel Index (“BTI”) Outlook – Annual Global Report & Forecast, launched as we speak by the Global Business Travel Association (GBTA) on the annual GBTA Convention in Denver.

The GBTA BTI™ report is a complete five-year forecast on enterprise journey spending masking 72 nations and 44 industries and contains insights from 7,300+ world enterprise vacationers. In its 17th version and made potential in partnership with Visa, this newest forecast displays a continued restoration in nominal phrases however alerts rising headwinds from world commerce tensions and financial uncertainty.

“As we thoughtfully anticipate reaching a new high in business travel spending this year, the outlook is steady ─ but the road ahead is more complex,” mentioned Suzanne Neufang, CEO of GBTA. “Trade policy uncertainty, inflationary pressures, and shifting global supply chains are reshaping how and where companies travel. This latest forecast reflects the resiliency of business travel and our industry as well as the acknowledgment of the risks ahead.”

According to the GBTA BTI, spending is projected to develop in 2027 by 6.4% and 6.3% in 2028—modestly larger than forecast a 12 months in the past. The tempo and trajectory of this development, nonetheless, will rely closely on the decision—or escalation—of worldwide commerce tensions.Global Trade Tensions Impact Growth Momentum

- The newest forecast displays a moderation from double-digit features of the previous two years. Trade coverage uncertainty has emerged as a key threat main to downward revisions in enterprise journey development projections for 2025 (from 10.4% projected a 12 months in the past, to 6.6% now) and 2026 (from 9.2% projected a 12 months in the past, to 8.1% now).

- Spending figures for 2024 have been additionally adjusted in this newest forecast – spending rose to $1.47 trillion, barely beneath the beforehand projected $1.48 trillion. While this nonetheless marked a brand new excessive, actual inflation-adjusted spending stays 14% beneath pre-pandemic ranges, underscoring a slower restoration in journey quantity.

Impacts Diverge Among Regional Markets and Industry Sectors

- In the 2025 forecast, the highest 15 markets for enterprise journey spending characterize $1.31 trillion. The two prime markets – the U.S. ($395.4 billion) and China ($373.1 billion) – collectively characterize 58% of that whole.

- The U.S. is projected to reclaim the highest spot this 12 months adopted by China (which led the checklist in 2024 and 2023), Germany, Japan, and the UK.

- India, South Korea, and Turkey are among the many quickest rising among the many prime 15 markets, whereas Spain and the Netherlands are forecast to have little to no development or a slight lower.

Business journey spending throughout industries may even proceed to differ:

- Trade-sensitive sectors akin to Manufacturing (which accounts for almost one-third of worldwide enterprise spending) and Wholesale Trade face heightened dangers if commerce tensions additional escalate.

- Service sectors like Arts & Entertainment and Professional Services have exceeded pre-pandemic benchmarks, with some rising journey spend by over 20%.

- Looking forward, Mining and Information and Communication are every anticipated to submit the strongest development in enterprise journey spend, whereas Agriculture faces the weakest outlook amid shrinking entry to export markets.

Global Business Traveler Sentiment Remains Strong

A world survey of over 7,300 enterprise vacationers throughout 33 nations in North America, Europe, Asia Pacific, Africa, Latin America and the Middle East reveals continued evolution and confidence in the worth of touring for work:

Business journey is seen as worthwhile—86% charge their journeys as worthwhile. Primary journey functions cited differ by area, with coaching and conferences topping the checklist globally.

Most vacationers (74%) took between one and 5 journeys in the previous 12 months, and over 80% say they’re touring for work as a lot or greater than earlier than 2019.

- Average journey spending rose to $1,128 USD (up from $834 in the 2024 survey).

- Expense methods are widespread (67% use them), and luxury with synthetic intelligence reserving instruments is rising, particularly in Asia Pacific (78%).

- Corporate card entry rose to 69%, led by North America (73%). However, solely half of cardholders are required to use them. Mobile pockets use can be up, with 64% adoption globally and 72% in Asia Pacific.

“As corporate travelers increasingly expect seamless, mobile-first payment experiences, it’s no surprise the report found notable usage of corporate credit cards through mobile wallets. At Visa, we’re focused on enabling this shift, offering secure, flexible digital payment tools that meet travelers where they are, and help organizations modernize their expense processes,” Edward Galvin, Vice President and head of North America B2B Commercial Payments, Visa.

[ad_2]

Source link